The 5-Minute Rule for Paul B Insurance Medicare Advantage

Get This Report about Paul B Insurance Medicare Advantage

Table of ContentsThe smart Trick of Paul B Insurance Medicare Advantage That Nobody is DiscussingAbout Paul B Insurance Medicare AdvantageSome Known Questions About Paul B Insurance Medicare Advantage.What Does Paul B Insurance Medicare Advantage Mean?

You will certainly intend to monitor your medical expenses to reveal you have actually fulfilled the deductible. Comparable to a devastating plan, you might be able to pay much less for your insurance policy with a high-deductible wellness strategy (HDHP). With an HDHP, you may have: One of these kinds of health strategies: HMO, PPO, EPO, or POSHigher out-of-pocket expenses than many sorts of plans; like various other strategies, if you reach the optimum out-of-pocket amount, the strategy pays 100% of your care.In order to have a HSA, you have to be enrolled in a HDHP.Many bronze plans may certify as HDHPs depending on the deductible (see listed below). hat physicians you can see. This varies depending on the sort of plan-- HMO, POS, EPO, or PPOPremium: An HDHP generally has a reduced premium contrasted to other plans.

Like with all strategies, your precautionary care is free even if you have not met the insurance deductible. Copays or coinsurance: Besides preventative care, you have to pay all your prices up to your insurance deductible when you go for treatment. You can make use of cash in your HSA to pay these prices.

Rumored Buzz on Paul B Insurance Medicare Advantage

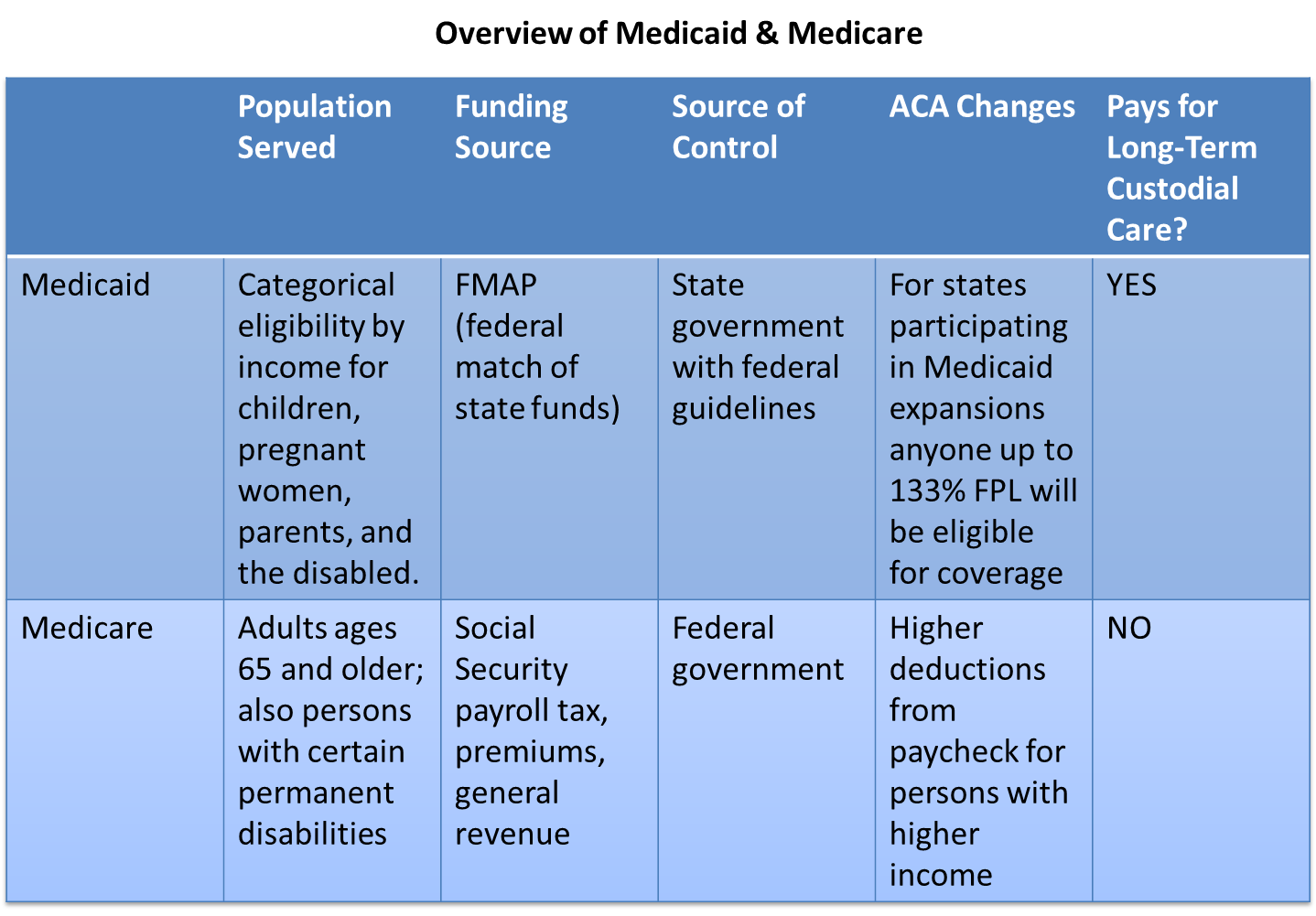

Medicare recipients pay absolutely nothing for a lot of precautionary services if the services are received from a medical professional or various other healthcare supplier who gets involved with Medicare (likewise referred to as approving task). For some precautionary solutions, the Medicare recipient pays nothing for the solution, however might have to pay coinsurance for the office browse through to receive these solutions.

The Welcome to Medicare physical examination is a single testimonial of your wellness, education and learning and therapy regarding preventative services, and also recommendations for various other treatment if needed. Medicare will certainly cover this exam if you get it within the first twelve month of registering partly B. You will pay absolutely nothing for the exam if the physician approves task.

Remember, you don't need to get the Welcome to Medicare physical examination before getting an annual Health exam. If you have actually had Medicare Part B for longer than 12 months, you can obtain a yearly wellness visit to establish or update a tailored avoidance plan based upon your existing wellness and threat elements (paul b insurance medicare advantage).

This test other is covered once every twelve month. Medicare Supplement (Medigap) insurance policy is medical insurance sold by personal insurance provider to cover some More Bonuses of the "voids" in costs not covered by Medicare. For plans marketed before June 01, 2010, there are fourteen standardized plans A via L. For plans offered on or after June 01, 2010, there are 11 standardized strategies A via N.

The Single Strategy To Use For Paul B Insurance Medicare Advantage

Plan E was additionally gotten rid of as it is the same to an already readily available plan. Two new strategy alternatives were included and also are currently readily available to recipients, which have higher cost-sharing responsibility and also reduced approximated costs: Plan M consists of half protection of the Medicare Component A deductible and does not cover the Component B insurance deductible Strategy N does not cover the Part B deductible and also includes a brand-new co-payment structure of $20 for each medical professional go to and $50 for each and every emergency situation space check out (forgoed upon admission to healthcare facility) Particular Medigap benefits were likewise be modernized.

In its area, a brand-new Hospice Care benefit was produced and also was included as a standard advantage available more tips here in every Medigap strategy. The under-utilized Preventive Care Benefit, which was previously only used in Plans E and also J, was gotten rid of. The 80 percent Medicare Part B Excess advantage, offered in Strategy G, was transformed to an one hundred percent coverage advantage.

Formerly insurers only needed to supply Plans An and also B. People enlisted in plans with an efficient day prior to June 01, 2010 have the right to keep their existing plans active. Medicare supplement insurance is ensured eco-friendly. As of January 1, 2020, the Medicare Gain Access To and CHIP Reauthorization Act (MACRA), which the federal government enacted in 2015, caused adjustments to the schedule of certain Medigap strategies.

Some Known Details About Paul B Insurance Medicare Advantage

"Freshly eligible" is defined as those individuals who initially become qualified for Medicare because of age, disability, or end-stage kidney condition, on or after January 1, 2020. Existing insureds covered under strategies C, F, or high-deductible plan F before January 1, 2020 might remain to restore their protection because of assured renewability.

On or after January 1, 2020, insurers are needed to use either Plan D or G along with An as well as B. The MACRA changes additionally created a new high-deductible Plan G that may be offered beginning January 1, 2020. For additional information on Medicare supplement insurance coverage plan design/benefits, please see the Benefit Graph of Medicare Supplement Plans.

Insurance firms might not reject the applicant a Medigap policy or make any costs rate differences due to the fact that of wellness status, asserts experience, clinical condition or whether the applicant is receiving healthcare services. Qualification for policies offered on a group basis is limited to those individuals who are members of the team to which the policy is provided.

Medigap policies may have up to a six (6) month waiting duration prior to pre-existing problems are covered. A pre-existing condition is a condition for which clinical guidance was provided or treatment was suggested or obtained from a physician within 6 months before the effective date of insurance coverage. Nonetheless, under New York State regulation, the waiting period may be either minimized or waived totally, relying on your private situations (paul b insurance medicare advantage).